Responding to Climate Change

In September 2022, the Company's Board of Directors approved a resolution to endorse the TCFD recommendations.

Based on the recognition that addressing climate change is one of the most important management issues, we will promote initiatives and information disclosure to reduce greenhouse gas emissions, including identifying and addressing climate change-related risks and opportunities.

Governance

We established the Sustainability Committee (chaired by the President). The purpose of this body, which is supervised by the Board of Directors, is to promote activities related to sustainability including activities to address climate change and determine sustainability strategies. We also established the Sustainability Promotion Committee (chaired by the director in charge of sustainability) as a subordinate body of the Sustainability Committee to promote various sustainability-related activities.

The Sustainability Committee reports to the Board of Directors on its deliberations and on any climate change-related risks and opportunities it identifies. In addition, the Sustainability Committee reflects these in the Medium-Term Management Plan and business plans. By integrating sustainability-related activities and business strategies, it will work to sustainably enhance our corporate value.

The Sustainability Committee, under the supervision of the Board of Directors, is in charge of promoting various activities related to climate change.

Strategy

We have conducted a scenario analysis of the impact of climate change risks and opportunities on our company.

In this scenario analysis, the project used external experts to identify and assess the significance of climate change-related risks and opportunities to define scenarios, quantitatively assess business and financial impacts, and consider measures to address the risks and opportunities.

The scenario analysis requires selecting and setting up several temperature range scenarios. We thereafter considered the impact on the Group by drawing up models for the following two scenarios based on scientific information such as that of the IPCC (Intergovernmental Panel on Climate Change) and that of the IEA (International Energy Agency).

We have confirmed that under any of the scenarios in this analysis it is possible to conduct resilient management.

In the 1.5°C scenario, it is assumed that regulations for decarbonization will be strengthened. The introduction of a carbon tax, combined with soaring raw material prices, will drive demand for the creation of more decarbonized products and services. On the other hand, in the 4°C scenario, the impact of physical risks will increase, giving rise to the need to respond to risks such as factory shutdowns and supply chain disruptions, as well as demand for infrastructure reinforcements.

| Item | 1.5°C scenario where climate change countermeasures, regulations, etc., are advanced | 4°C scenario where climate change countermeasures, regulations, etc., are not advanced |

|---|---|---|

| Overview of scenarios | Scenarios in which severe measures are taken against climate change and the temperature rise is suppressed to about 1.5°C or less by 2100 compared to before the industrial revolution | Scenarios in which effective measures against climate change are not in place and temperatures rise by about 4°C by 2100 compared to before the industrial revolution |

| Model | Scenarios of increased transition risks in policy and regulation, markets, technology, and reputation | Scenarios of increased physical risks, such as more severe natural disasters, rising sea levels, and more extreme weather events |

| Regulations on climate change are strengthened, such as the introduction of a carbon tax. Consumer preferences shift to an environmental focus. | Climate change causes more extreme weather events and more natural disasters. | |

| Parameters used when estimating impact | The RCP 2.6 scenario was used, by referring to information from the IPCC and the IEA. | The RCP 8.5 scenario was used, by referring to information from the IPCC and the IEA. |

| Overview of results | Mainly transition risks/opportunities are manifested. | Mainly physical risks/opportunities are manifested. |

| Risk Climate change regulations and changes in consumer preferences will require increased costs and the development of environment-friendly products. |

Risk There is a risk of factory shutdowns and supply chain disruptions due to an increase in natural disasters. |

|

| Opportunity Growth in the ZEH (net zero energy house) and ZEB (net zero energy building) market and the use of wooden buildings, which have a decarbonization effect, could increase demand for decarbonization products. |

Opportunity The need to reinforce infrastructure, including buildings, is becoming apparent. |

|

| Countermeasures | Capital investment and R&D investment have been focused on energy conservation. Going forward, in light of stricter regulations for decarbonization and growing environmental awareness, we will not only promote energy conservation but also R&D investments including the review of product materials | Until now, we have prepared for natural disasters, etc., using a BCMS (Business Continuity Management System). We will continue our BCMS activities and strengthen our risk response measures to natural disasters. |

Points common to both scenarios The Sustainability Committee is the central component of our system for promoting activities related to sustainability, including climate change issues. Under this system, we will refine our assessment of risks and opportunities and further develop our response measures. |

||

| Category | Event | Major potential financial impact | Financial impact | Time frame of occurrence | |

|---|---|---|---|---|---|

| Transition risks | Policies and regulations | Introduction of carbon tax | The introduction of a carbon tax increases the cost of CO2 emissions. | Medium | Medium term |

| Enforcement of energy conservation standards | Sales slow down due to higher transition costs and failure to meet standards as a result of the reinforcement of the Act on Rationalizing Energy Use and stricter CO2 emission reduction targets. | Major | Short term to medium term | ||

| Shift to renewable energy | Costs increase due to higher prices for renewable energy. | Medium | Medium term | ||

| Stricter regulations on waste disposal | Waste disposal costs increase and a shift to reusable or recyclable products is required. | Minor | Medium term to long term | ||

| Technological risks | Need for environment-friendly products | Costs increase due to switching to components that address climate change, and sales opportunities are lost due to delays in responding to climate change. | Major | Short term to medium term | |

| Transition to low-emission technologies | Product competitiveness weakens on higher costs associated with the transition to low-carbon materials. | Minor | Short term to medium term | ||

| Market risks | Shrinking product demand | Growing environmental awareness stifles demand for products with high CO2 emissions. | Major | Medium term to long term | |

| Market uncertainty | Unexpected fluctuations in energy costs arise. | Minor | Medium term | ||

| High raw material costs | Profit declines due to an inability to pass on rising raw material costs to sales prices. | Major | Medium term | ||

| Reputation | Changes in consumer preferences | Sales opportunities are lost due to a slow environmental response. | Major | Medium term to long term | |

| Consumable materials avoided by consumers | Sales of consumables that cause CO2 emissions decline as consumers avoid them due to their image as disposable items. | Medium | Medium term to long term | ||

| Corporate reputation | A slow environmental response impacts our corporate image, hampering hiring efforts and causing a decline in the share price. | Non- calculated | Short term to medium term | ||

| Physical risks | Acute Chronic | Increase in natural disasters | Flooding caused by extreme weather leads to factory shutdowns and supply chain disruptions. | Major | Short term to medium term |

| Chronic | Rising sea levels | Rising sea levels lead to flooding at our business locations. | Minor | Long term | |

| Average temperature rise | More forest fires increase the cost of lumber, while longer construction periods due to avoidance of heat-related risks decrease the number of buildings, mainly those made of wood. | Major | Medium term to long term | ||

| Opportunity | Resource efficiency | Changes in the market environment | Increase in the number of wooden buildings, which have the effect of reducing CO2 emissions, and the expansion of the ZEH and ZEB market lead to an increase in the number of new buildings. | Medium | Medium term |

| Energy sources | Energy costs | Reduce cost volatility by installing renewable energy facilities. | Minor | Medium term | |

| Products and services | Changes in demand | Improve competitiveness by developing and marketing products with reduced environmental impact by using renewable/recycled raw materials, etc. | Major | Medium term to long term | |

| Market | Changes in demand | Building reconstruction needs increase due to the need to reinforce structures. | Major | Medium term to long term | |

| Resilience | Products and services | It is likely that the need for labor-saving equipment will increase due to shorter work times at construction sites caused by rising temperatures. Resilience is also enhanced by continuously strengthening the BCP of the entire supply chain in preparation for disasters. | Medium | Short term to long term | |

- Time horizons

- In assessing the risks and opportunities associated with climate change, we have established the following time horizons:

- short term: up to about two years

- medium term: about three to 10 years

- long term: 10 years or more

Risk management

As a result of the materiality identification conducted as one of the various sustainability-related activities, we have positioned addressing climate change as an extremely important issue both from our stakeholders perspective and from our own perspective.

Activities related to climate change are led by the Sustainability Promotion Committee, a subordinate body of the Sustainability Committee, which promotes the identification, assessment, and management of risks, which are then discussed and decided by the Sustainability Committee.

In the scenario analysis, risk management will be ensured with periodic assessments of the business or financial impact of each risk quantitatively, including new regulatory assessments.

The results of the climate change risk assessment are reported to the Board of Directors and reflected in thinking for the Medium-Term Management Plan and business plans. These risks are integrated with Companywide risk management in coordination with the Corporate Governance Committee (which is attended by all directors, including outside directors, and held four times a year), a body whose purpose includes promoting corporate ethics, legal compliance, and risk management.

Goals and results

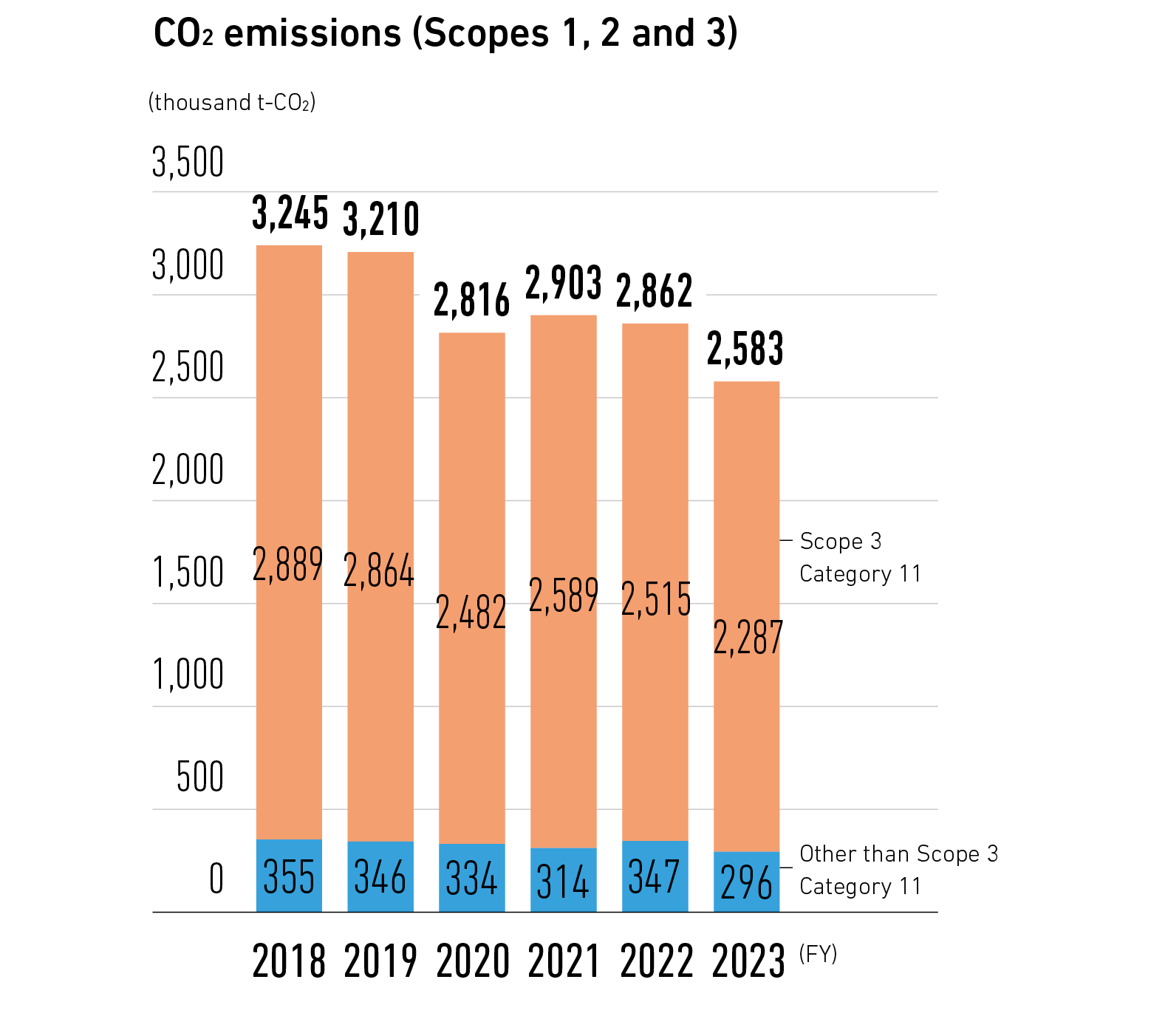

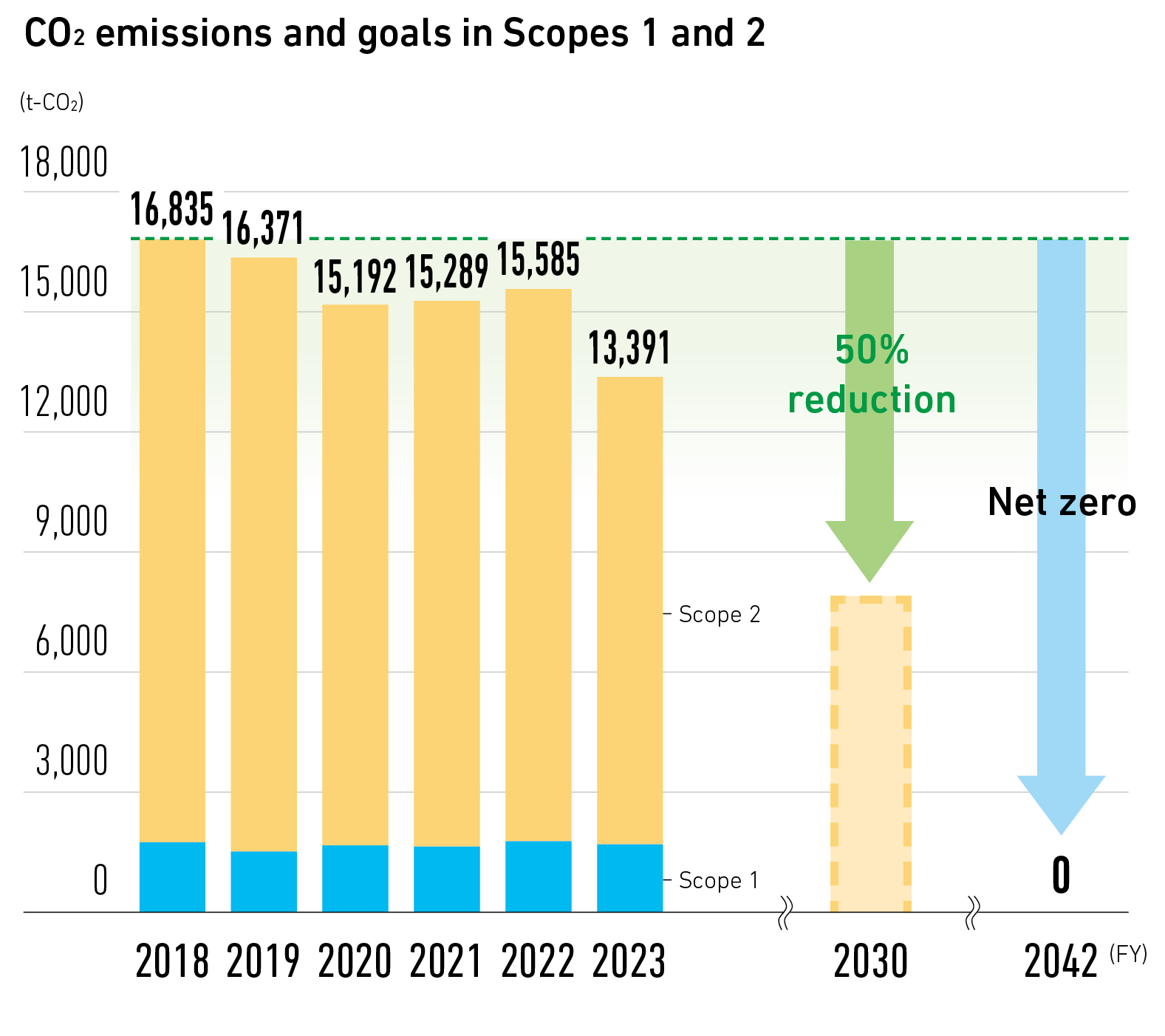

In fiscal 2023, CO2 emissions were 1,710 tons for Scope 1 (direct emissions from business), 11,681 tons for Scope 2 (indirect emissions from power consumption), and 2,569,525 tons for Scope 3 (indirect emissions other than Scopes 1 and 2 [emissions by other companies related to business activities]). Of Scope 3, Category 11 emissions (emissions from the use of products sold) were 2,286,801 tons. In light of our high CO2 emissions in Scope 3 Category 11, we have set the following medium- to long-term goals for minimizing climate change-related risks with CO2 emissions as the indicator.

| Item | Medium- to long-term goals | Fiscal 2023 actual |

|---|---|---|

| Scopes 1 and 2 carbon neutral |

1.Reduce CO2 emissions 50% from fiscal 2018 level by 2030 2.Achieve net zero CO2 emissions (carbon neutral) by 2042 |

13,391t |

| Reduction of Scope 3 Category 11 | Reduce CO2 emissions 30% from fiscal 2018 level by 2030 for Scope 3 Category 11 (emissions from the use of products sold) | 2,286,801t |

Initiatives and plans

In addition to increasing the efficiency of air conditioning,converting lighting to LEDs, eliminating air leaks at factory facilities, and reducing equipment operation at night at some factories, we are pursuing initiatives including the installation of solar power systems and purchases of nonfossil-fuel certificates.

We will promote these activities while constantly examining and implementing new measures and investments for reducing CO2 emissions.