Corporate Governance

Approach to Corporate Governance

MAX aims to further grow our business and increase our corporate value by continuing to receive support from our customers. To achieve this goal, we recognize the importance of taking the initiative to enhance our corporate governance based on trusting relationships with our stakeholders.

- 1Conduct proper and appropriate information disclosure

- 2Strengthen our management supervision function

- 3Ensure stable corporate management

- 4Accelerate decision making

- 5Respect people

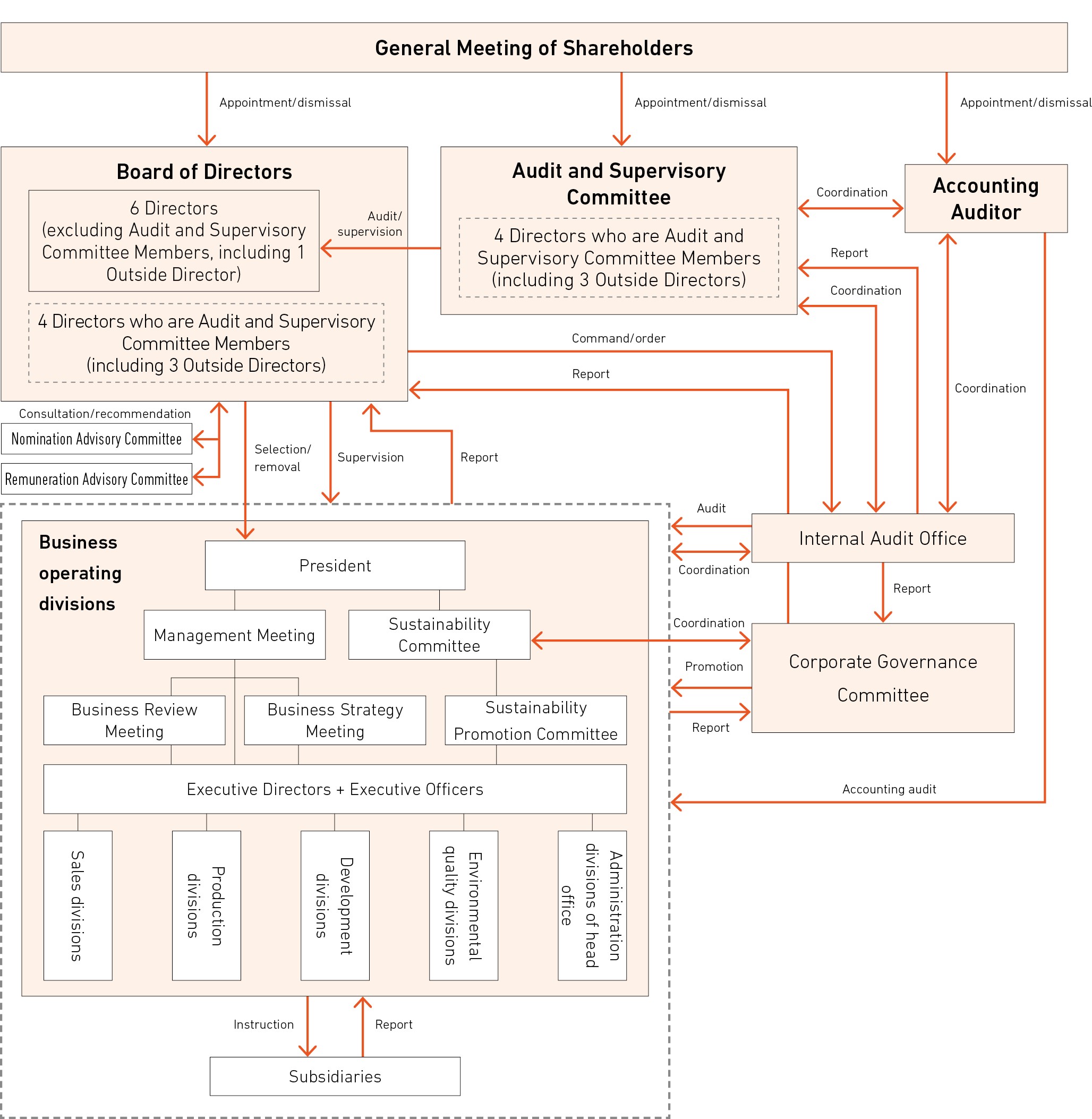

Corporate Governance System

Institutional design

As the institutional structure of our company, MAX has adopted a structure with an Audit and Supervisory Committee and has introduced an executive officer system. As the main institutions of the current corporate governance system, in addition to the statutory Board of Directors and Audit and Supervisory Committee, we are working to enhance corporate governance by establishing advisory boards for nomination and remuneration, management meetings, and Corporate Governance Committee.

| Main items | Details |

|---|---|

| Organizational form | Company with an Audit and Supervisory Committee |

| Number/tenure of Directors (excluding Directors who are Audit and Supervisory Committee Members) | 6 persons/1 year |

| Number/tenure of Directors who are Audit and Supervisory Committee Members | 4 persons/2 years |

| Number of Outside Directors | 4 persons |

| Voluntary committees | Nomination Advisory Committee, Remuneration Advisory Committee |

| Number of Outside Directors who are designated by independent officers | 4 persons |

| Audit corporation | KPMG AZSA LLC |

| 2015 | Determined the basic policy on the establishment of internal control systems |

|---|---|

| 2016 | Transitioned to a company with an Audit and Supervisory Committee |

| 2018 | Formulated the basic policy on corporate governance |

| 2020 | Revised Rules of the Board of Directors (newly established "Matters for discussion") |

| Established the Nomination Advisory Committee and the Remuneration Advisory Committee | |

| 2021 | Resolved on the basic policy on remuneration for Directors |

| 2023 | Abolished anti-takeover measures Appointed a female outside director Introduced restricted share-based remuneration plan for officers |

Board of Directors

The Company's Board of Directors consists of six directors (excluding directors who are members of the Audit Committee, one independent Outside Director), and four directors who are members of the Audit Committee (including three independent Outside Directors). The board is chaired by the President and Representative Director.

It meets once a month and as necessary, and met 17 times in fiscal 2023.

The Board of Directors is positioned as a body that makes decisions on matters stipulated in laws, regulations, and the Articles of Incorporation, as well as important matters concerning management stipulated in the Company's Rules of the Board of Directors, such as management policies, business plans, investment plans, and establishment of and investment in subsidiaries, and supervises the execution of operations, to promote the Company's sustainable growth and enhancement of medium- to long-term corporate value in an effort to improve profitability and capital efficiency based on fiduciary responsibilities and accountability to shareholders.

In fiscal 2023, the Board of Directors reviewed and supervised the status of initiatives in each business area, and also discussed and deliberated the Medium-term Management Plan and initiatives to improve sustainability, which were identified as issues in the evaluation of the effectiveness of the Board of Directors.

| Name | Status of activities | |

|---|---|---|

| Director | Mitsuteru Kurosawa | 4/4 |

| Tatsushi Ogawa | 17/17 | |

| Yoshihiro Kaku | 17/17 | |

| Masahito Yamamoto | 17/17 | |

| Hideyuki Ishii | 13/13 | |

| Koji Kato | 13/13 | |

| Outside Director | Kako Kurasawa | 13/13 |

| Director, full-time Audit and Supervisory Committee Member | Tomohiko Nakamura | 17/17 |

| Outside Director (Audit and Supervisory Committee Member) | Minoru Hirata | 17/17 |

| Asaka Kanda | 17/17 | |

| Shoji Kiuchi | 17/17 |

Audit and Supervisory Committee

The Company's Audit and Supervisory Committee consists of one full-time Audit and Supervisory Committee Member who is a directoer and three part-time Audit and Supervisory Committee Members who are Independent Outside Directors. The reason for selecting a full-time Audit and Supervisory Committee Member is to strengthen the audit/supervisory function of the Audit and Supervisory Committee in gathering information from Directors (excluding Directors who are Audit and Supervisory Committee Members) and sharing information at important internal meetings as well as ensuring thorough coordination with the internal audit department and the Audit and Supervisory Committee. The committee is chaired by a full-time Audit and Supervisory Committee Member.

It meets once a month and as necessary, and met 17 times in fiscal 2023.

As an organization that plays a role in the company's supervisory function and as a statutory independent institution entrusted by the shareholders, the committee performs the duties stipulated in the laws, regulations, and the Company's Rules of the Audit and Supervisory Committee, including auditing the execution of duties of Directors, preparing audit reports; deciding the details of proposals regarding the appointment, dismissal, and non-reappointment of the accounting auditor; and deciding the opinions of the Audit and Supervisory Committee regarding the appointment/dismissal or resignation of and remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members).

| Name | Status of activities | |

|---|---|---|

| Director, full-time Audit and Supervisory Committee Member | Tomohiko Nakamura | 17/17 |

| Outside Director (Audit and Supervisory Committee Member) | Minoru Hirata | 17/17 |

| Asaka Kanda | 17/17 | |

| Shoji Kiuchi | 17/17 |

Nomination Advisory Committee

The Company established the Nomination Advisory Committee,the majority of whose members are Independent Outside Directors, as an advisory body to the Board of Directors to enhance transparency and objectivity of the nomination of Directors. The committee met four times in fiscal 2023. The Board of Directors respects and takes into account the committee's recommendation when deciding the candidates of Directors.

The Nomination Advisory Committee deliberates on the validity and appropriateness of the overall process for appointing Directors, and makes reports or statements to the Board of Directors. The members of the committee are appointed from Directors by a resolution of the Board of Directors, with the majority of committee members consisting of Independent Outside Directors. The chairperson of the committee is selected by the committee. Tatsushi Ogawa, Shoji Kiuchi, and Kako Kurasawa were appointed as committee members, and Shoji Kiuchi was selected as the chairperson.

In fiscal 2023, the committee deliberated on the composition of the Board of Directors and the appointment, etc., of Directors, and submitted recommendations to the Board of Directors.

| Name | Status of activities | |

|---|---|---|

| Director | Mitsuteru Kurosawa | 1/1 |

| Tatsushi Ogawa | 3/3 | |

| Outside Director (Audit and Supervisory Committee Member) | Minoru Hirata | 3/3 |

| Asaka Kanda | 1/1 | |

| Shoji Kiuchi | 4/4 |

Remuneration Advisory Committee

The Company established the Remuneration Advisory Committee, the majority of whose members are Independent Outside Directors, as an advisory body to the Board of Directors to enhance transparency and objectivity regarding remuneration, etc., for Directors (excluding Directors who are Audit and Supervisory Committee Members) and Executive officers. The committee met three times in fiscal 2023. The Board of Directors respects and takes into account the committee's recommendation when resolving on remuneration, etc., for Directors (excluding Directors who are Audit and Supervisory Committee Members).

The Remuneration Advisory Committee deliberates on the validity and appropriateness of the overall process for determining remuneration, and then makes reports or statements to the Board of Directors. Committee members are appointed from Directors by a resolution of the Board of Directors, with the majority of committee members consisting of Independent Outside Directors. The chairperson of the committee is selected by the committee. Tatsushi Ogawa, Asaka Kanda, and Kako Kurasawa were appointed as committee members, and Asaka Kanda was selected as the chairperson.

In fiscal 2023, the committee deliberated on remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members), proposals for executive bonuses to be submitted to the General Meeting of Shareholders, the amount of individual executive bonuses for Directors, the introduction of share-based remuneration, etc., and submitted recommendations to the Board of Directors.

| Name | Status of activities | |

|---|---|---|

| Director | Mitsuteru Kurosawa | 2/2 |

| Tatsushi Ogawa | 1/1 | |

| Outside Director (Audit and Supervisory Committee Member) | Minoru Hirata | 2/2 |

| Asaka Kanda | 3/3 | |

| Shoji Kiuchi | 1/1 |

Management Meeting

The Company holds the Management Meeting hosted by the President, once a month as a body executing operations, thereby reviewing in advance the matters to be referred to the Board of Directors for discussion and supporting the President's decision making.

The Management Meeting consists of five Directors (excluding Outside Directors and Directors who are Audit Committee Members) and relevant staff nominated by the President. It is working to improve the quality of decision making to enable flexible response to changes in the business environment and decisions to be made based on on-site information.

In addition, the Business Review Meeting has been established to confirm the plans and results of each quarter, and the Business Strategy Meeting has been established to advance companywide, cross-functional initiatives. Both meetings, which are subordinate bodies of the Management Meeting, are hosted by the President. Matters discussed at the Business Review Meeting are reported to the Board of Directors meeting to be held in the month following the date of the Business Review Meeting.

In fiscal 2023, the Management Meeting confirmed and discussed the formulation of our Medium-term Management Plan and growth strategies for each business area, such as our rebar tying tool business. The meeting also examined and discussed themes such as how to address sustainability issues and create new businesses.

Corporate Governance Committee

The Company convenes the Corporate Governance Committee, which is headed by the President and held quarterly, as an organization that promotes corporate ethics, legal compliance, risk management, and other compliance issues at the Company.

The Corporate Governance Committee is composed of Directors, Executive Officers, and division representatives, and is attended by the four Audit and Supervisory Committee Members.

The Corporate Governance Committee is working to improve and make progress in risk management companywide, based on the main themes of internal audit reports, case studies of other companies, risk management status by division, review of rules, and information security audits.

In fiscal 2023, in addition to the above, we planned and reported the results of subsidiary risk assessments and employee selfchecks.

Sustainability Committee

We established the Sustainability Committee (chaired by the President) as a decision-making body for sustainability strategies under the supervision of the Board of Directors to promote sustainability-related activities, and the Sustainability Promotion Committee (chaired by the Director in charge of sustainability) as a subordinate body of the Sustainability Committee to promote various activities related to sustainability.

The Sustainability Promotion Committee (hereinafter, the “Promotion Committee”) met five times in fiscal 2023 to engage in discussions while utilizing the knowledge of Outside Directors.

The committee discussed themes such as examination of engagement survey results and ways of proceeding with human rights due diligence.

Furthermore, in consideration for the importance of sustainability-related activities, the content of the Promotion Committee's discussions are reported at the Board of Directors in the next month following the date of the committee meeting.

The Sustainability Committee met once in fiscal 2023 to review the activities of the Promotion Committee and discuss future initiatives.

Based on this discussion, we have formulated a Medium-term Management Plan and business plan, and are working to integrate sustainability activities and business strategies to sustainably improve corporate value.

| Name | Position | Main bodies established | ||||||

|---|---|---|---|---|---|---|---|---|

| Board of Directors | Audit and Supervisory Committee | Nomination Advisory Committee | Remuneration Advisory Committee | Management Meeting | Corporate Governance Committee | Sustainability Committee | ||

| Tatsushi Ogawa |

President | Chair person |

- | ○ | ○ | Host | Host | Chairperson |

| Yoshihiro Kaku |

Senior Managing Director, Senior Executive Officer | ○ | - | - | - | ○ | ○ | ○ |

| Masahito Yamamoto |

Managing Director, Senior Executive Officer | ○ | - | - | - | ○ | ○ | ○ |

| Hideyuki Ishii |

Director, Executive Officer | ○ | - | - | - | ○ | ○ | ○ |

| Koji Kato |

Director, Executive Officer | ○ | - | - | - | ○ | ○ | ○ |

| Kako Kurasawa |

Outside Director | ○ | - | ○ | ○ | - | ○ | ○ |

| Tomohiko Nakamura |

Director, full-time Audit and Supervisory Committee Member | ○ | Chairperson | - | - | - | ○ | - |

| Asaka Kanda |

Outside Director (Audit and Supervisory Committee Member) | ○ | ○ | - | Chair person |

- | ○ | - |

| Shoji Kiuchi |

Outside Director (Audit and Supervisory Committee Member) | ○ | ○ | Chair person |

- | - | ○ | - |

| Mari Yajima |

Outside Director (Audit and Supervisory Committee Member) | ○ | ○ | - | - | - | ○ | - |

| Takashi Iwamoto |

Senior Executive Officer | - | - | - | - | ○ | ○ | - |

| Katsunori Manabe |

Senior Executive Officer | - | - | - | - | - | ○ | ○ |

| Daisuke Yasue |

Executive Officer | - | - | - | - | - | ○ | - |

| Shintaro Yoshida |

Executive Officer | - | - | - | - | - | ○ | - |

| Akio Kitaya |

Executive Officer | - | - | - | - | ○ | ○ | ○ |

| Hitoshi Igarashi |

Executive Officer | - | - | - | - | - | ○ | ○ |

| Hideo Kashihara |

Executive Officer | - | - | - | - | - | ○ | - |

| Mitsugu Takezaki |

Executive Officer | - | - | - | - | - | ○ | - |

| Makoto Hisatomi |

Executive Officer | - | - | - | - | - | ○ | - |

| Nobuo Suda |

Executive Officer | - | - | - | - | - | ○ | ○ |

| Name | Reasons for election | Status of activities |

|---|---|---|

| Kako Kurasawa | The Company has elected Kako Kurasawa because it has determined that she is qualified to serve as Outside Director of the Company, considering that she has been involved in sustainability-related business in her previous and current positions, and in addition to her expertise in sustainability, she has experience working overseas in the manufacturing industry. | Attendance at meetings of the Board of Directors 13/13 |

| Asaka Kanda | The Company has elected Asaka Kanda because it has determined that he is qualified to serve as Outside Director who is an Audit and Supervisory Committee Member of the Company, considering that he has professional knowledge as an attorney-at-law and experience involved in corporate management as Outside Corporate Auditor and Outside Director (Audit and Supervisory Committee Member) at other companies. | Attendance at meetings of the Board of Directors 17/17 |

| Shoji Kiuchi | The Company has elected Shoji Kiuchi because it has determined that he is qualified to serve as Outside Director who is an Audit and Supervisory Committee Member of the Company, considering that he has professional knowledge as an attorney-at-law and careers serving as a domestic affairs conciliation commissioner, member of a committee on administrative complaints, and others, as well as a wealth of experience and broad knowledge gained from serving in such positions. | Attendance at meetings of the Board of Directors 17/17 |

| Mari Yajima | The Company has determined that Mari Yajima is qualified to serve as Outside Director who is an Audit and Supervisory Committee Member of the Company because she has professional knowledge as a certified public accountant and deep insight into corporate governance gained through her experience as an auditor at other companies and as General Manager of the Internal Audit Department of an insurance company. | - |

In order to objectively determine the independence of Outside Directors and outside corporate auditors, the Company has established the following "Criteria for Independence of Outside Directors and Outside Corporate Auditors" in reference to the criteria for determining the independence of independent directors and outside corporate auditors established by Tokyo Stock Exchange, Inc. Furthermore, all Outside Directors who meet the qualifications for an Independent Director are designated as Independent Directors.

|

Standards for Determining the Independence of Outside Directors The Company shall deem an Outside Director or a candidate for Outside Director of the Company to be independent of the Company when all of the following requirements are satisfied

|

Composition of the Board of Directors

In order to secure the efficacy of the Board of Directors, MAX's policy is to appoint directors according to their abilities, regardless of their age, gender, or other characteristics. While considering a balance of knowledge, experience, and abilities in the entire Board of Directors, we endeavor to appoint directors capable of sufficiently fulfilling their roles in the execution and supervision of the MAX Group's management.

When appointing the six directors (excluding directors who are members of the Audit and Supervisory Committee), we strive to ensure diversity in knowledge, experience, and abilities. Furthermore, we also periodically visit our overseas subsidiaries and business partners in order to obtain an understanding of the actual situation and cultivate international sensibility.

The four directors who are members of the Audit and Supervisory Committee possess appropriate experience and abilities in auditing, etc., as well as necessary knowledge in finance, accounting, and legal affairs. Two of the directors possess sufficient knowledge of legal affairs as lawyers. One of directors possesses sufficient knowledge of finance and accounting as a certified public accountant.

Moving forward, MAX will work to balance diversity in terms of gender and internationality, while also paying attention to the appropriate size of the Board of Directors.

Evaluation of effectiveness of the Board of Directors

The Company analyzes and evaluates the effectiveness of the Board of Directors (hereinafter "effectiveness evaluation") to improve the function of the Board of Directors.

Since 2018, the effectiveness has been evaluated by self-evaluation based on an anonymous questionnaire using an outside institution, with the evaluation items consisting of the composition and operation method of the Board of Directors, and the support system for Directors, among other things.

The results of the effectiveness evaluation conducted in April 2024 showed the effectiveness of the Board of Directors.

With regard to the discussion on sustainability initiatives, etc., which were addressed as an ongoing issue in the previous fiscal year, the evaluation result was maintained at a high level due to discussions centering on initiatives related to human rights due diligence, but we continue to recognize this as an issue to be addressed.

The Board of Directors will continue to share the challenges to enhance autonomous corporate governance, and will sequentially put them into practice to resolve the issues.

Executive remuneration

The Company's executive remuneration, etc., comprises three elements: monthly remuneration (fixed remuneration), performance-linked remuneration (executive bonuses), and compensation for restricted stock transfers. With respect to the shares granted, the Company's prescribed restricted transfer agreement is to be concluded, which restricts the subject director from transferring or otherwise disposing of the shares until he/she retires or resigns from the position predetermined by the Company's Board of Directors. The ratio of each remuneration is designed to be generally 50% for fixed remuneration, 35% for executive bonuses, and 15% for stock-based remuneration, although the ratio of executive bonuses may vary depending on the Company's business performance.

Remuneration for Directors who are Audit and Supervisory Committee Members

Remuneration for Directors who are Audit and Supervisory Committee Members is determined by discussion among Directors who are Audit and Supervisory Committee Members based on their roles and responsibilities as executives within the remuneration limits resolved at the Ordinary General Meeting of Shareholders. Regarding executive remuneration, only monthly remuneration is paid.

Method for determining remuneration, etc., for each individual Director

Regarding the remuneration, etc., of directors (excluding directors who are members of the Audit and Supervisory Committee) The Board of Directors shall, after deliberation by the Compensation Advisory Committee, an advisory body to the Board of Directors, which is composed of a majority of independent Outside Directors, and after reporting to the Board of Directors, pass resolutions on monthly compensation for each executive position, proposals for executive bonuses to be submitted to the General Meeting of Shareholders, the amount of individual executive bonuses, and the number of shares of restricted stock to be granted to each individual as compensation for restricted stock, among other items. The resolution of the Board of Directors is subject to the approval of the General Meeting of Shareholders. Resolutions of the Board of Directors shall be made with respect to the report of the Compensation Advisory Committee.

| Monthly remuneration (fixed remuneration) |

Performance-linked remuneration (executive bonus) |

Restricted Stock Compensation (non-monetary remuneration) |

|

|---|---|---|---|

| Recipients | Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members), Outside Directors, Directors who are Audit and Supervisory Committee Members | Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members) | Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members) |

| Method of provision | Monetary | Monetary | Stock |

| Evaluation indicator | - | The total source of bonuses for officers (excluding Directors who are Audit and Supervisory Committee Members) and employees is 28% of the result distribution profit calculated based on the amount of consolidated operating income, and performance-linked remuneration (executive bonus) for each individual linked to monthly remuneration is calculated according to calculations based on internal rules. | The amount of remuneration credits to be granted to each eligible director is calculated by multiplying the base remuneration amount by a coefficient established for each executive position based on his/her role and responsibilities as an executive remuneration, and the number of shares corresponding to the calculated amount is determined and granted based on a resolution of the Board of Directors. |

| Method of provision | Monthly monetary payment | Monetary payment after the end of the General Meeting of Shareholders | Shares corresponding to the amount contributed during the period covered |

| Category | Total remuneration (millions of yen) |

Subtotal by type of remuneration (millions of yen) |

Number of recipients | ||

|---|---|---|---|---|---|

| Monthly remuneration (fixed remuneration) |

Performance-linked remuneration, etc. | Non-monetary remuneration, etc. | |||

| Directors (excluding Directors who are Audit and Supervisory Committee Members) (Outside Directors) |

229 (6) |

106 (6) |

103 (-) |

19 (-) |

7 (1) |

| Directors (Directors who are Audit and Supervisory Committee Members) (Outside Directors) |

43 (25) |

43 (25) |

- | - | 4 (3) |

| Total (Outside Directors) |

272 (31) |

149 (31) |

103 | 19 | 11 (4) |

- *1The table above includes one Director (who is not an Audit and Supervisory Committee Member) who retired at the conclusion of the 92nd Ordinary General Meeting of Shareholders held on June 28, 2023.

- *2The amounts paid to Directors (excluding Directors who are Audit and Supervisory Committee Members) do not include compensation, etc., for the employee portion of Directors who serve concurrently as employees.

- *3Performance-linked remuneration, etc., consists of an executive bonus resolved at the 93rd Ordinary General Meeting of Shareholders.

- *4The actual amount of the result distribution profit for fiscal 2023, which serves as a performance indicator, was ¥18,260 million.

Response for strengthened internal controls

To strengthen internal controls, MAX holds the biannual Internal Audit Summit with participation by audit-related organizations such as the Internal Audit Office, Integrated Digital Innovation Department, and Environment and Quality Assurance Department. At the Summit, participants share information on the status of internal audits and risk response at each department. We also have all employees conduct self-checks for the purpose of reflecting on their own activities, identifying risks in the Group, and taking appropriate measures.

Status of Internal Audit

MAX has established an Internal Audit Office consisting of four people, and conducts audits that address company-wide risks and audits that contribute to the effectiveness and efficiency of operations. These audits target the Company and its domestic and overseas subsidiaries. Audits are performed at each site or department once every two years or once every three years according to the Basic Internal Audit Plan approved by the President and reported to the Board of Directors. The results of the internal audits are reported to the Corporate Governance Committee and the Board of Directors, both of which are attended by all directors, on a quarterly basis.

As an effort to ensure the effectiveness of internal audits, the Internal Audit Office and full-time Audit and Supervisory Committee members regularly exchange opinions and coordinate information. In addition, the Internal Audit Office provides prior explanations and exchanges opinions with the Audit and Supervisory Committee mainly on the contents of reports made at the Corporate Governance Committee meetings. In addition, once a quarter, the Internal Audit Office, the Audit and Supervisory Committee, and the accounting auditor hold a meeting to exchange opinions to promote information collaboration. The secondary control divisions are informed through the Corporate Governance Committee and feedback of internal audit results, etc., in order to understand the status of control and strengthen the control system.

Cross-Shareholdings

The Company holds cross-shareholdings in order to maintain and strengthen transactions. The Company makes decisions on these holdings based on whether or not they are beneficial to the Company in order to enhance its corporate value over the medium to long term. In the fiscal year ended March 31, 2024, the Company reduced the number of policy stock holdings by two issues.With regard to the criteria for exercising voting rights related to strategic stock holdings, we will start with dialogue and carefully decide whether to approve or disapprove proposals for stocks whose performance has deteriorated to such an extent that their valuation value and return have deteriorated, or for proposals that may harm the Company's interests.

| Number of issues | Balance sheet amounts (Millions of yen) | |

|---|---|---|

| Unlisted stocks | 24 | 250 |

| Stocks excluding unlisted stocks | 10 | 5,716 |

Dialogue with shareholders

To oversee constructive dialogue with shareholders, MAX has established a department in charge of IR under the officer in charge of IR. Through coordination with divisions such as corporate planning, general affairs, and accounting, the department in charge of IR engages in fair and timely disclosure of situations related to management, finance, etc. At the end of the year and the end of the second quarter, MAX holds a financial results briefing attended by the President and the IR officer. At the end of the first quarter and the end of the third quarter, we hold a financial results briefing by teleconference attended by the IR officer. We also actively respond to requests for dialogue from shareholders and investors.

The department in charge of IR examines the content of opinions and requests from shareholders and investors, and issues reports to management executives as necessary. At the time of dialogue with shareholders and investors, based on our disclosure policy, we take sufficient caution regarding the management of insider information in accordance with our internal rules. We also limit dialogue with shareholders, investors, etc., for a certain period as a "silent period” before the announcement of financial results information.

Please see below for the status of dialogue with shareholders.

Dialogue with Shareholders and Investors