Dialogue with Shareholders and Investors

Dialogue with Shareholders and Investors

To oversee constructive dialogue with shareholders, MAX has established a department in charge of Investor Relations under the officer in charge of Investor Relations. Through coordination with divisions such as corporate planning, general affairs, and accounting, the department in charge of Investor Relations engages in fair and timely disclosure of situations related to management, finance, etc. At the end of the year and the end of the second quarter, MAX holds a financial results briefing attended by the President and the Investor Relations officer. At the end of the first quarter and the end of the third quarter, we hold a financial results briefing by teleconference attended by the Investor Relations officer. We also actively respond to requests for dialogue from shareholders and investors.

The department in charge of Investor Relations examines the content of opinions and requests from shareholders and investors, and issues reports to management executives as necessary. At the time of dialogue with shareholders and investors, based on our disclosure policy, we take sufficient caution regarding the management of insider information in accordance with our internal rules. We also limit dialogue with shareholders, investors, etc., for a certain period as a "silent period" before the announcement of financial results information.

Main Respondents in Dialogue

| Implementation Form | Main Correspondents | Number of times Implemented |

|---|---|---|

| Financial Results Briefing for Analysts and Institutional Investors | President, Senior Managing Director, General Manager of Corporate Division |

4times |

| Shareholder and Investor Meetings | General Manager of Corporate Division, General Manager, Corporate Communications Dept, Investor Relations, Corporate Communications Dept |

118times |

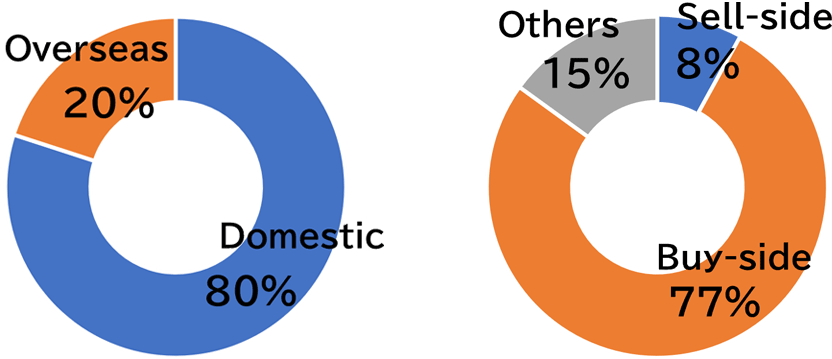

Summary of Shareholders and Investors with whom dialogue was conducted

Main Themes of the dialogue, and issues of interest to Shareholders and Investors

| Main Themes | Issues of Interest |

|---|---|

| Management strategy | ・ Strategies and specific initiatives for enhancing corporate value over the medium to long term ・ Impact of US reciprocal tariffs ・ Approach to inventory levels |

| Tools for Concrete Structures (Rebar tying tools) |

・ Changes in demand in North America and Europe, the main areas ・ Activities in new development areas such as the Middle East and ASEAN etc. ・ Market size and penetration rate ・ Changes in the macro environment and the status of competitors |

| Individual Business | ・ Competitive environment of individual businesses and future outlook ・ Status of price transfers in response to high raw material costs ・ Business strategies for unprofitable and declining businesses |

| Capital Policy | ・ Required level of cash on hand ・ Use and priority of cash, including growth investments ・ Measures to be taken if planned investments cannot be executed ・ Future shareholder composition |

Status of Feedback provided to management and the Board of Directors

Report to the Board of Directors on the status of dialogue with shareholders and investors (twice a year).

Report on highly important matters as appropriate.

Details of improvements through dialogue

| Request | Details of Improvements |

|---|---|

| Please provide a list showing the actual results for rebar tying tools on a quantity basis. | We disclosed graphs showing quarterly growth rates (in the US, Europe, and Japan) for tools for concrete structures, mainly rebar tying tools, for the last three fiscal years in our financial results briefing materials. |

| Please tell us about the lineup and production locations of rebar tying tools. | We disclosed our lineup of rebar tying tools and production bases in our financial results briefing materials. |

| Please update the potential market size for rebar tying tools. | We have added the Middle East and ASEAN regions, which we are developing as new markets, to our estimated market size. Additionally, taking into account the current exchange rates and rising product prices, we have updated our estimate market size for tools for concrete structures. |