Medium-term Management Plan

MAX has formulated a three-year Medium-Term Management Plan (fiscal years ending March 2025 to March 2027).

Based on steady results for the first fiscal year ending March 2025, MAX announced a revised Medium-Term Management Plan on April 30, 2025.

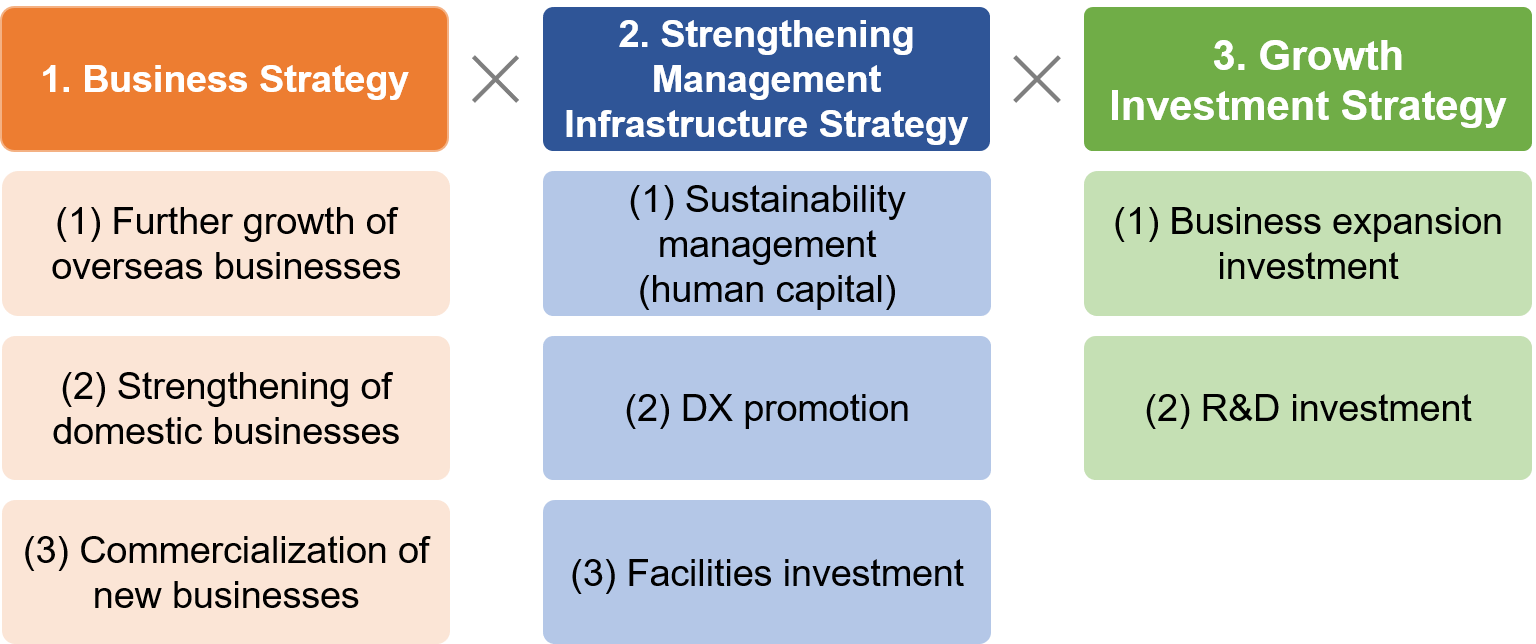

Basic strategy of the Medium-term Management Plan(FY2024-2026)

Set forth the theme of "Create the Future," the three-year Medium-term Management Plan started in April 2024, we will create Max with high corporate value by implementing three basic strategies: "Business Strategy," "Strengthening Management Infrastructure Strategy," and "Growth Investment Strategy."

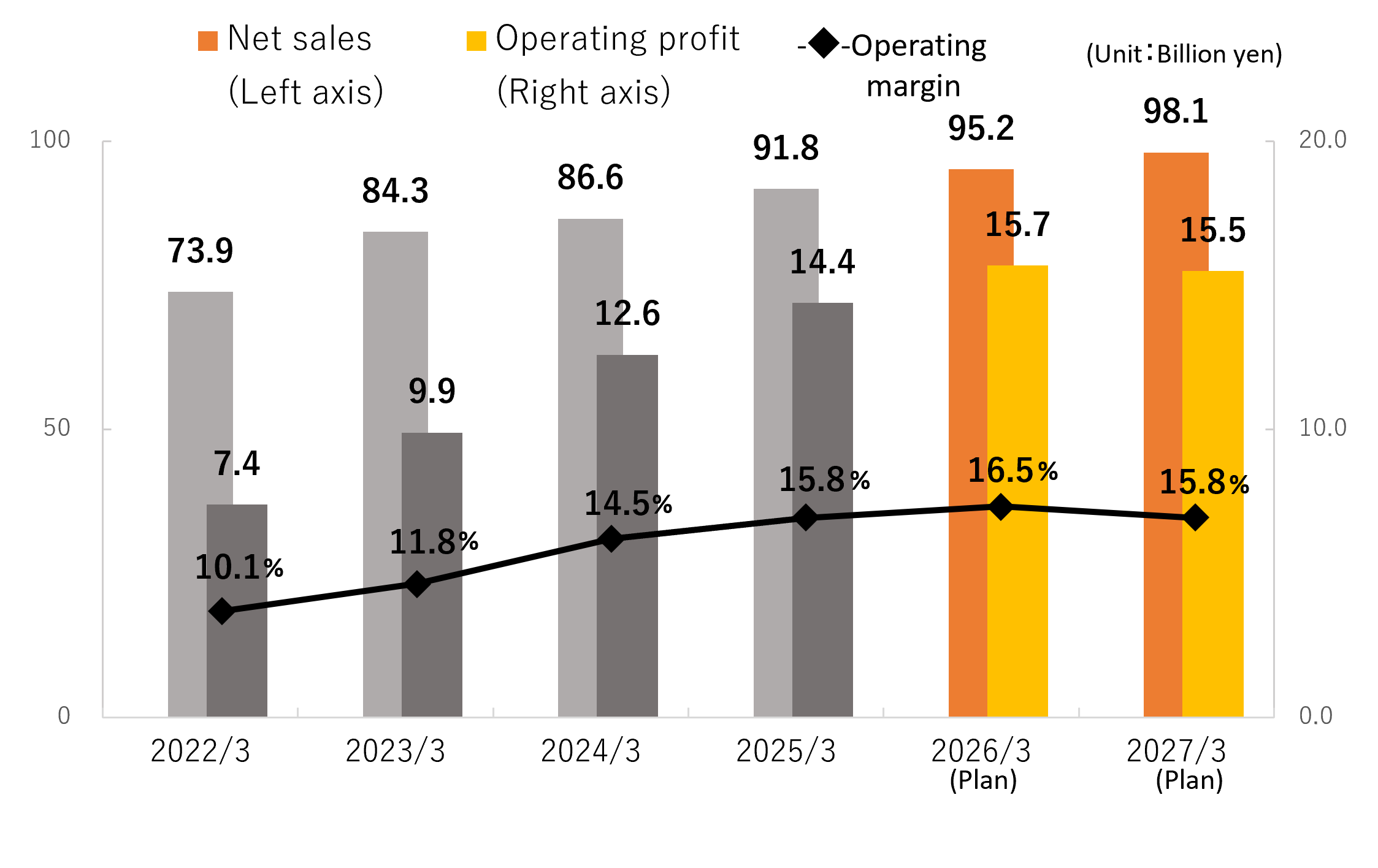

Target value

For the fiscal year ending March 31, 2025, the first year of the Medium-term Management Plan (FY2024 - FY2026), actual results were net sales of 91.8 billion yen, operating profit of 14.4 billion yen, and an operating margin of 15.8%.

For the fiscal year ending March 31, 2026, the second year of the plan, we are forecasting net sales of 95.2 billion yen, operating profit of 15.7 billion yen, and an operating margin of 16.5%.

| FY2024 | FY2025 (Plan) |

FY2026* (Plan) |

|

|---|---|---|---|

| Net sales | 91.8 | 95.2 | 98.1 |

| Operating profit | 14.4 | 15.7 | 15.5 |

| Ordinary profit | 14.8 | 15.8 | 15.7 |

| Profit attributable to owners of parent | 11.2 | 11.8 | 11.9 |

| Operating margin | 15.8% | 16.5% | 15.8% |

| ROE | 10.9% | 11.1% | 11.0% |

*Revised July 31,2025

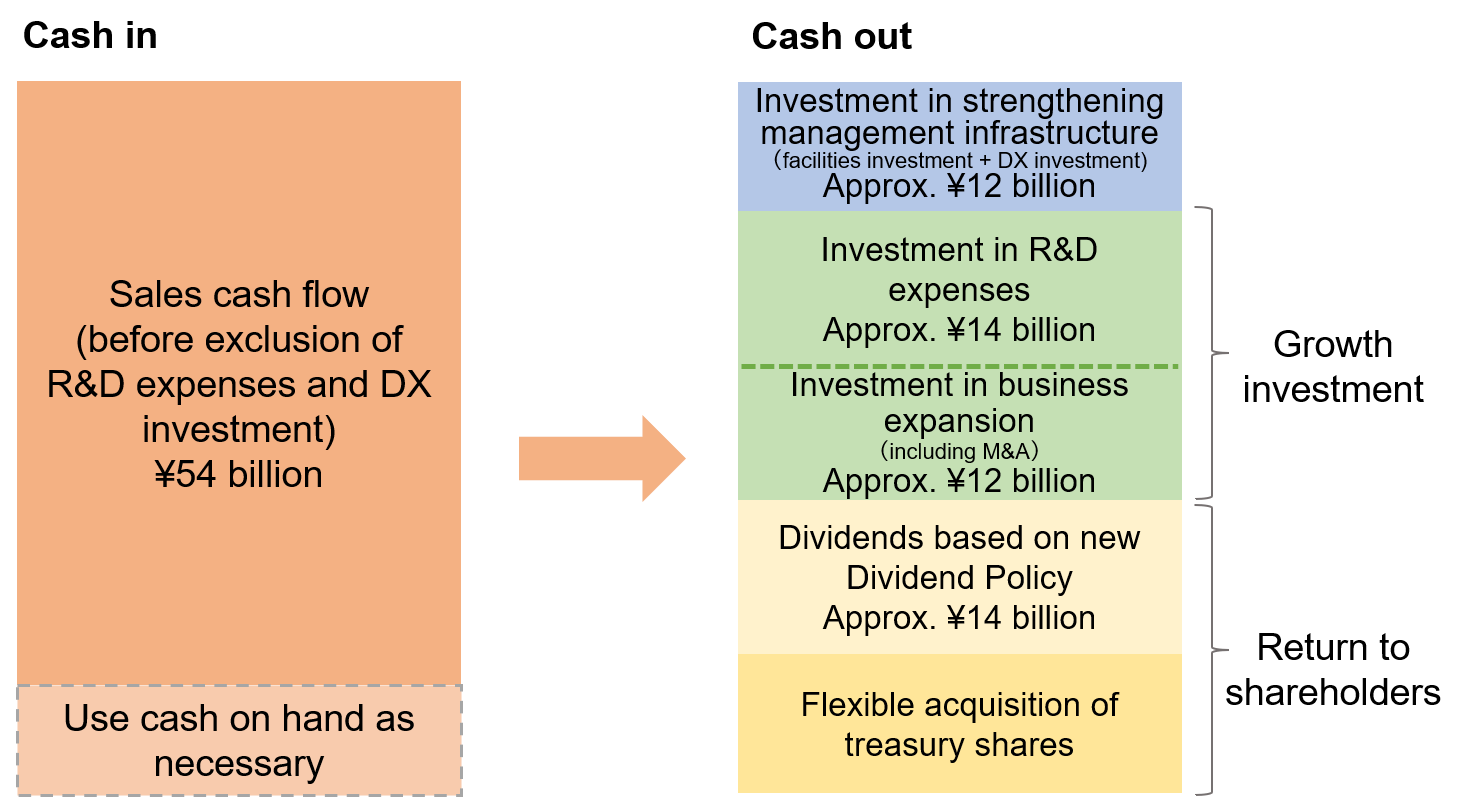

Cash Flow Allocation

(FY 2024-FY 2026 Plan)

We will actively utilize cash inflows from operating activities and cash on hand to achieve sustainable growth. Specifically, we plan to invest about 12.0 billion yen in investments to strengthen the management infrastructure, including capital expenditures and DX-related investments, and about 26.0 billion yen in growth investments, including R&D expenditures and investments in business expansion, including M&A. In addition, we will pay a dividend of approximately 14.0 billion yen based on our dividend policy, " Guideline of a ratio of dividends to net assets ratio of 5.0% and a dividend payout ratio of 50%, as based on consolidated financial results ", and we will carry out flexible acquisition of treasury shares.

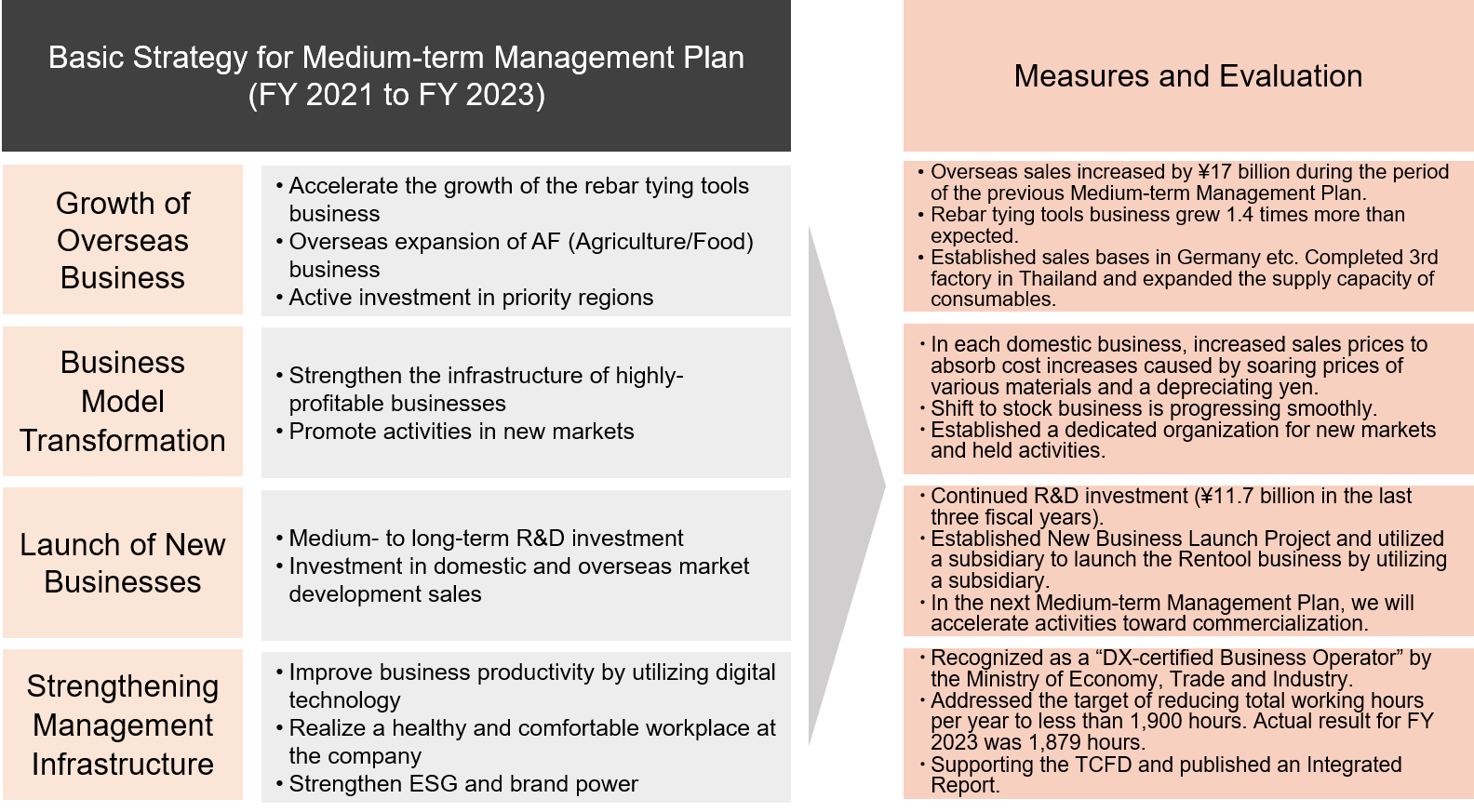

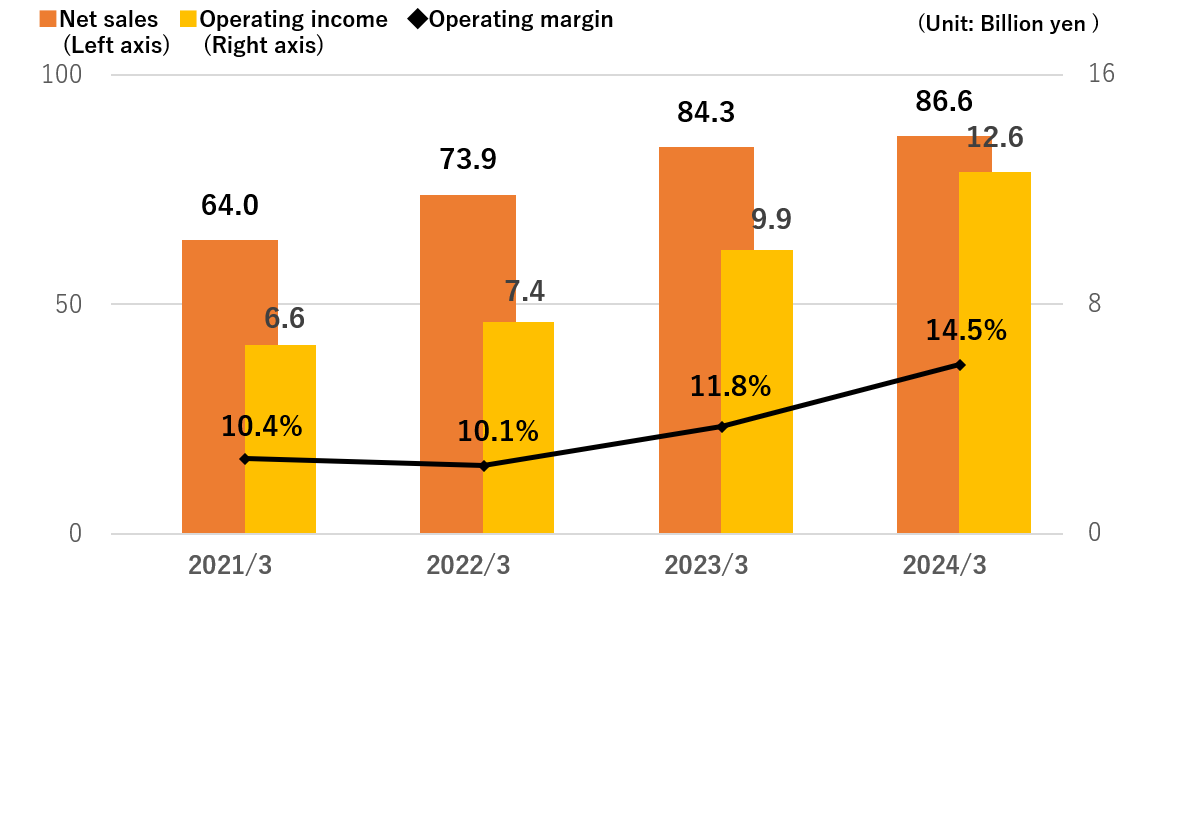

Review of Previous Medium-term Management Plan

(FY2021-2023)

During the period of the previous Medium-term Management Plan from the fiscal year ending March 31, 2022 to 2024, we were able to substantially achieve our initial targets due to growth in the rebar tying tools business, promotion of price revisions in response to soaring raw material and other costs, and yen depreciation in foreign exchange. As a result, ROE improved to 11.1%, a level higher than the target of the previous Medium-term Management Plan (8%) and cost of shareholders' equity (6-7%).

| Target (Announced April 28, 2021) |

Results | |

|---|---|---|

| Net sales | 72.9 billion yen | 86.6 billion yen |

| Operating profit | 9.0 billion yen | 12.6 billion yen |

| Operating margin | 12.3% | 14.5% |

| Net profit attributable to shareholders of parent company | 7.0 billion yen | 10.4 billion yen |

| ROE | 8.0% | 11.1% |

Measures and Evaluation for Basic Strategy

The growth of overseas business, which was one of the basic strategies in the previous Medium-term Management Plan period, progressed steadily with the expansion of the rebar tying tools business in Europe and the United States. The transformation of the business model, centered on the domestic business, has been promoted by increasing selling prices and shifting to a stock business, and the profitability of the domestic business has steadily increased. The creation of new businesses is gradually taking shape, including the launch of the Rentool business as a result of an in-house business contest. In the next Medium-term Management Plan, we will accelerate moves toward commercialization of various ideas. Strengthening the management infrastructure included the promotion of DX initiatives, a comfortable work environment, and the publication of an integrated report.